Priced Out of Your Medicare Supplement? There's a Better Way.

Keep your comprehensive coverage and lower your monthly premiums. We show you how with a powerful combination of a Medicare Advantage (MAPD) plan and a Hospital Indemnity plan

Over 300 5-Star Reviews!

Feeling the Squeeze of Skyrocketing Medicare Supplement Premiums?

If you've been shocked by the recent increase in your Medicare Supplement (Medigap) premiums, you are not alone. Many seniors are finding their trusted Medigap plans are becoming unaffordable, with some seeing double-digit percentage increases in their monthly costs. These rising premiums are not your fault. A combination of factors, including the long-term effects of the COVID-19 pandemic on healthcare utilization and shifts in the insurance market, are driving up costs for everyone..

According to recent reports, some of the largest Medicare Supplement

providers have implemented rate hikes of 15-20% in 2025 alone

This trend is forcing many to question if they can continue to afford their current level of coverage. But what if you didn't have to choose between comprehensive protection and a budget you can live with?

The Solution:

The "We Fix Medigap" Strategy

Comprehensive Coverage Without the Hefty Price Tag

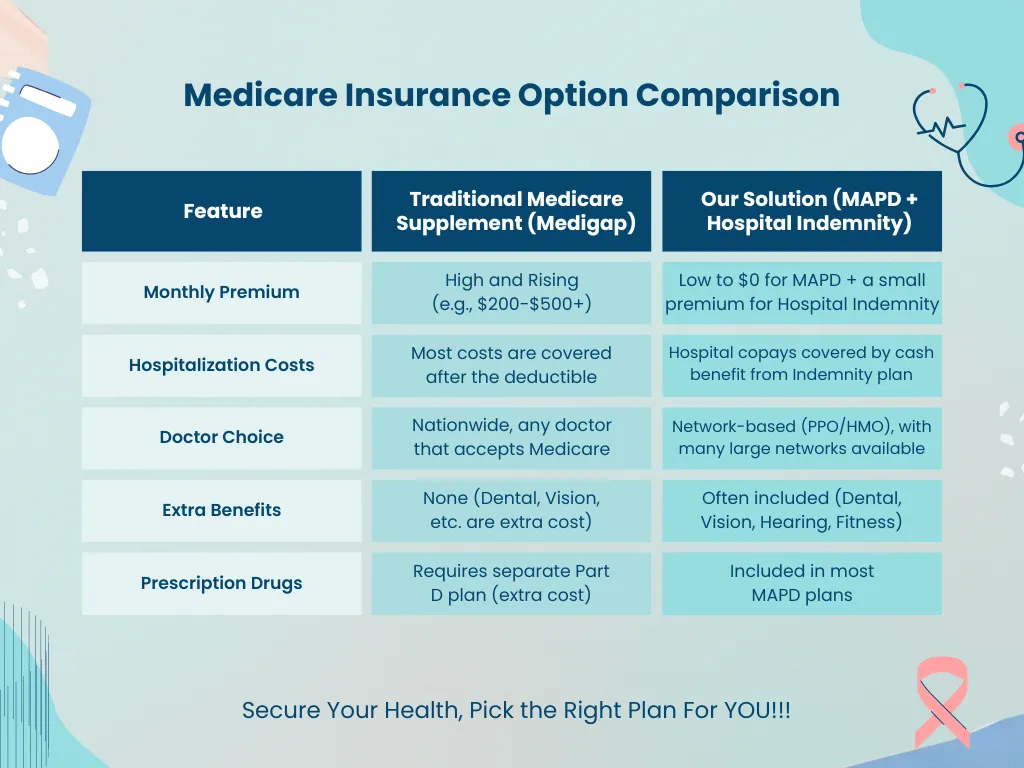

At WeFixMedigap.com, we specialize in a powerful strategy that allows you to maintain a high level of coverage while significantly lowering your out-of-pocket premium costs. We do this by combining the strengths of two widely available insurance products: a Medicare Advantage (MAPD) plan and a Hospital Indemnity plan.

Medicare Advantage plans, also known as Part C, are an increasingly popular alternative to Original Medicare and a Medigap plan. These plans are offered by private insurance companies approved by Medicare and often come with very low or even $0 monthly premiums. In addition to covering all the services that Original Medicare covers, many MAPD plans also include valuable extra benefits not found in Medigap, such as:

•Prescription Drug Coverage (Part D)

•Routine Dental and Vision Care

•Hearing Exams and Aids

•Fitness Memberships

Filling the Gaps: Hospital Indemnity Insurance

While MAPD plans offer incredible value, they do have out-of-pocket costs, such as copayments and deductibles, especially for hospital stays. This is where a Hospital Indemnity plan comes in. This supplemental insurance pays you a fixed, pre-determined cash benefit for each day you are in the hospital. This money can be used for anything you choose, from covering your hospital copays to paying for household expenses while you recover. It acts as a financial safety net, filling the potential gaps in your MAPD plan.

The Best of Both Worlds:

MAPD + Hospital Indemnity

By combining a low-cost MAPD plan with an affordable Hospital Indemnity plan, you can create a comprehensive coverage solution that rivals the protection of a traditional Medigap plan, but at a fraction of the monthly cost. You get the broad coverage and extra benefits of an MAPD, with the peace of mind that comes from knowing you have a financial cushion in case of a hospital stay.

Your Path to Lower Premiums and Peace of Mind

Free, In-Depth Consultation

We start with a no-pressure conversation to understand your current coverage, your healthcare needs, and your budget. This allows us to determine if our strategy is the right fit for you.

Customized Plan Comparison

We provide a clear, side-by-side comparison of your current Medigap plan and our recommended MAPD + Hospital Indemnity combination. You'll see the potential savings and coverage details in black and white.

Hassle-Free Enrollment

If you decide to make the switch, our expert team will guide you through every step of the enrollment process. We handle the paperwork and ensure a seamless transition to your new, more affordable coverage.

We Work for You, Not the Insurance Companies!!

WeFixMedigap.com is not an insurance company. We are independent advocates for seniors who are tired of overpaying for their Medicare coverage. Our mission is to provide you with the information and tools you need to make an informed decision about your healthcare. We are committed to transparency, integrity, and putting your financial well-being first.

Stop Overpaying for Your Medicare Supplement!